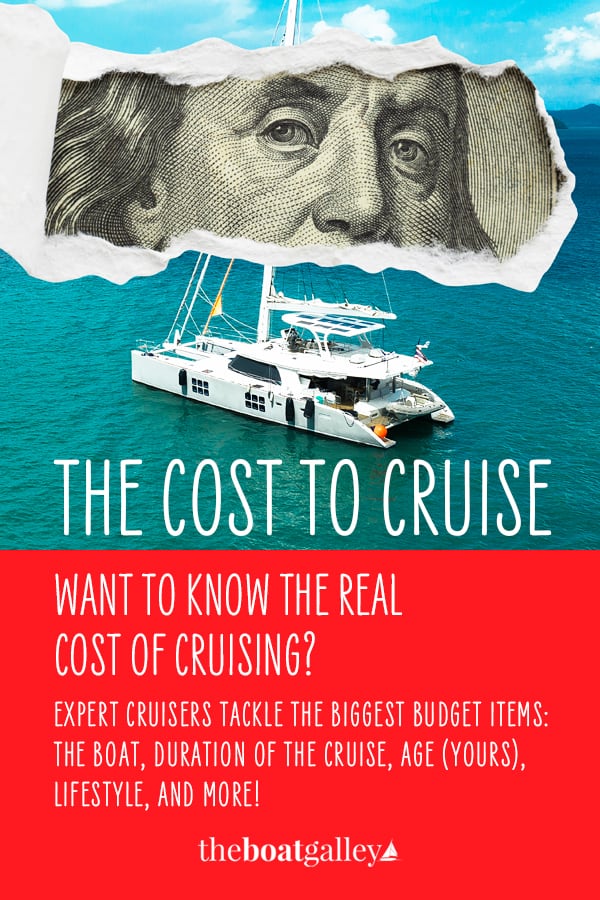

How much does it cost to cruise on your own boat is one of the most frequent pre-cruising questions that people have. And rightly so. It’s also a question that I’ve tended to stay away from as there are so many factors that affect the answer.

The short answer is that cruising can cost almost anything you want it to. I know people who cruise on $1,500 a month and others who average $10,000 a month.

But that doesn’t help you figure out where you may fall. Instead of giving hard numbers, I’d like to discuss some of the variables that will affect what it will cost you to cruise.

Your Boat

Most discussions of the cost to cruise acknowledge that your boat choice drives a lot of the expenses. If you took out a loan to buy your boat, you obviously have to include that payment . . . and the cost of any required boat insurance. Both size and complexity of the boat will play a big role in other expenses.

But I think that many of these discussions miss another important point: what condition is your boat in when you begin cruising? Many people spend a year or more working on their boat before they “begin cruising.” They leave with a boat in tip-top shape. Then there are others, such as us, who do the “rolling refit” — we start cruising immediately after buying the boat, and upgrade as we go along.

Our annual cruising expenses — at least in the first years — are thus going to be considerably higher than someone who has already done their upgrades, or who has decided that they simply aren’t going to do any. But our pre-cruising expenses were less.

Numerous sources also estimate ongoing boat expenses as a percentage of boat cost. The idea is that a more expensive boat is likely bigger with more complex systems to maintain. And that may be true, to a point. But I don’t think that initial boat cost has a lot to do with ongoing expenses, especially if you have made major upgrades on the boat . . . or are planning to make them.

Sometimes, too, more expensive boats come with well-designed systems that cut down on annual maintenance while less expensive boats may have ongoing problems from poor gear and installations in the past. Batteries and charging systems are one place where money spent upfront may save a bundle down the road. And hence, the boat value will be higher and the annual expense lower, which throws the “percentage of boat cost” out of whack.

Planned Duration of Cruising

How long you intend to cruise is also likely to affect your expenses. If you are doing a short-term cruise — say one to two years — you are more likely to be willing to put up with “camping” conditions. If you see the boat as your long-term home, you are more likely to want creature comforts. And creature comforts cost more upfront as well as more to maintain.

The same goes for expenses off the boat: if you see living frugally as something you’re doing for a couple of years in order to have this experience — say, carrying groceries back to the dinghy dock versus getting a cab; drinking the happy hour $2 beer instead of the $6 umbrella drink that you would really prefer — it’s a lot more acceptable than “I’ll never be able to do that again.”

Further, many who cruise as a year or two sabbatical tend to operate on the “if it breaks, we’ll do without.” It’s both a matter of not wanting to take the time out of the limited time they have available and not wanting the monetary expense. This also reduces the number (and cost) of spares they carry.

Your Age

Our idea of an acceptable lifestyle changes as we grow older. We lose some of our physical strength and agility. Things that may be seen as part of the adventure to a twenty- or thirty-something start falling into the “why am I doing this?” category at 70.

A rowing dinghy and ferrying water from shore just aren’t things that Dave and I want to deal with any more: a year ago we invested in a more reliable (but older) outboard than what we’d had; we have (and use even in the harbor) a water maker. Both those — and numerous other things — add to our costs.

Your Lifestyle

Your basic lifestyle isn’t going to change just because you’re on a boat. If you like eating out, you’re going to want to go to restaurants. You know if you prefer marinas (easy access to shore, showers, wi-fi and the social life) or anchoring out (dinghy exploring, nature, more time alone). Your personal style will affect many expenses: food, alcohol, clothing, hair, electronics and “toys” such as kayaks and paddleboards.

One of the biggest ‘mistakes’ I see people make is creating a budget that doesn’t reflect their tastes.

Just because you read a blog where someone says they live on less than a thousand dollars a month doesn’t mean it’s right for you. When you look at cruisers with seemingly low expenses, look to see if they leave some things out of their report: many don’t include alcohol, health insurance or even some boat expenses.

Then look to see what low-budget cruisers are actually doing every day in order to live on that budget: rowing the dinghy so they don’t use gas? catching fish for dinner or going without? using 10-year-old charts? living without refrigeration? going engineless until they can afford the parts to repair it?

Think seriously before you say “sure, I can do that.” Many things sound romantic to read about . . . but aren’t when you’re the one living the life. I’m not saying that you can’t live on a tiny budget, just that it’s a decision that needs to be taken seriously.

Dramatically changing your lifestyle to make a budget “work” almost always does one of two things: you’ll either hate the lifestyle or blow the budget. Either one will make you quit cruising sooner than planned.

Cruising involves a lot of tradeoffs and compromises, and I don’t mean to discourage anyone. But giving up just about everything that is a part of your current lifestyle isn’t realistic.

Health Insurance

Your health insurance situation and decisions will greatly affect your monthly expenses, and while not specifically a cruising expense must be considered. And yes, this will vary by your country of residence.

When we began cruising, we had virtually free health insurance provided as part of Dave’s retirement package. When the company filed for bankruptcy several years later, we switched to paying for our own through a retiree’s group . . . and then after a few years, that went away also. Now we are on our own. I tell this story in case you are counting on health insurance from a former employer . . . it can go away in the blink of an eye and, if so, can change your budget dramatically.

Between Dave’s Medicare premium, the Medicare supplement, prescription coverage, my Blue Cross coverage (Blue Cross is good for cruisers as it has a nationwide network that includes US territories) and medical evacuation coverage, we pay almost $900 a month for health insurance (2020 update: now almost exactly $1500 a month) . . . and have a reserve set aside since my coverage has a very high deductible.

The US health insurance landscape seems to be constantly in flux, and I don’t want to get into a political debate here. We have always chosen to maintain our US insurance even when cruising outside the US as we know that if any serious medical condition were to arise, we’d want to return to the US. Yes, we could get good treatment elsewhere but this is where we have our family and friends and where we would want to be. Your decision may be different but health care costs have to be considered and planned for.

Family Visits

Visits “home” need to be factored into the annual expenses. Some people may do so rarely; others may make several trips a year. If you have close family relationships, make sure to plan accordingly. This one item has derailed many cruising budgets for grandparents!

Remember, too, that a visit “home” means not just the airplane ticket, but a marina or haul out for the boat, maybe a boat watcher, taxis, motels, rental cars and meals out. And you’ll probably bring back a few trinkets for the boat.

DIY or Hiring Work

Many people point to doing work yourself instead of hiring professionals as a big money-saver. I’ll agree, to a point. The hidden costs of doing it yourself are that the work may take longer (a larger yard or marina bill or just time spent at anchor and not cruising) and that you are more likely to add a few “as long as we’re at it” items. And if it’s the first time you’ve done something, there may be problems and you may have to buy extra parts.

Don’t get me wrong — there are other benefits to DIY-ing. You learn your boat better and, if it’s something that you’ve learned how to do, now you know for the next time. You’re more self-sufficient. And you are more likely to notice “nearby” problems and fix them before they become major issues.

Dave and I tend to do most of our own work and while I think we save some money, the other benefits are greater.

Expenses Come In Clumps

Living ashore, most people’s expenses are reasonably steady from month to month. The opposite is true when cruising: you’ll have months with high expenses when annual expenses hit or you’re preparing for a longer passage or a trip to remote areas, and times with low expenses when in places where you just can’t buy stuff.

Money management and the ability to put money aside for long-term expenses is an important skill. Take a look at the cost of sails, electronics, engine repowering, rigging and so on. Think about when you may have to replace these items and plan for them. Just because this month’s — or even this year’s — expenses are low does not mean you can go and “blow” the excess in the budget.

Real-World Numbers

I don’t keep detailed records of what we spend and so can’t report our expenses. A friend of mine, Tammy on Dos Libras, does publish theirs and I’d say it’s fairly typical for many retirees:

Costs of a two-year cruise for a family of four:

Sailing BeBe has also kept scrupulous records for their 10-year circumnavigation . . . and are also retirees . . . on an Amel:

For a look at what it’s like to cruise on $15,000 a year:

Read Next

Flatten the learning curve with practical how-to info that gives you the confidence to step into life aboard.

Start Learning Today

Carolyn Shearlock has lived aboard full-time for 17 years, splitting her time between a Tayana 37 monohull and a Gemini 105 catamaran. She’s cruised over 14,000 miles, from Pacific Mexico and Central America to Florida and the Bahamas, gaining firsthand experience with the joys and challenges of life on the water.

Through The Boat Galley, Carolyn has helped thousands of people explore, prepare for, and enjoy life afloat. She shares her expertise as an instructor at Cruisers University, in leading boating publications, and through her bestselling book, The Boat Galley Cookbook. She is passionate about helping others embark on their liveaboard journey—making life on the water simpler, safer, and more enjoyable.

Lance Merlees Gundersen says

Excellent article. I’m troubled by the part that says, “One of the biggest ‘mistakes’ I see people make is creating a budget that doesn’t reflect their tastes.” Is tacky and classless a type of taste? Do I have to improve?! 😉

The Boat Galley says

Why yes, that’s a type of taste. And there’s nothing wrong with creating a budget that embraces it! 🙂

Kyra Crouzat says

We spent less than $1500 a month when cruising Mexico for 16mths… and around that in the South Pacific (depending where we were – sometimes wouldn’t spend anything for weeks) – like they say, you spend what you have! Isn’t great that there are so many ways we can approach cruising!

The Boat Galley says

Yes, you certainly can cruise cheaply — thanks for affirming that. My concern is people who budget low but don’t want to live that way. I do know a bunch of low budget cruisers who are very happy — and big parts of the difference seem to be age and their pre-cruising lifestyle.

Kyra Crouzat says

Completely agree with you – I think it’s important to be honest with yourself about your priorities, what comforts you are willing to live without or what matters to you and arent willing to live without etc. I wrote about this in case you’re interested http://nyonlog.blogspot.co.nz/2014/01/a-question-of-dollars.html?m=0

The Boat Galley says

Thanks for the link!

Jessica Marie says

Cool article Adam Pappas

Jim Pensinger says

We cruised the USA and Caribbean between 1989 and 1994 in a 40 ft steel sailboat I built. Over those 5 years, we averaged less than $800 per month including a trip home each year and a haul out each year.

Carolyn Shearlock says

I think costs may have gone up some since then 🙂 I bet most boats today also have more electronics than you did — and they tend to be expensive!

Alper Baykal says

This article is the best one that I have ever read about the cost of our life.

Waiting for you to come to Turkey again 🙂 it is still beautiful and cheap except marinas.

Thanks for all your contribution to the cruisors. Cheers!

Verena @ PacificSailors.com says

Great post! I hope to start adding to our Finances page once I figure out our expenses of cruising the Pacific NW. When we cruised Mexico we spent about $2,200 per month including all insurance and boat maintenance. Here are our numbers: http://pacificsailors.com/about/dinero/cruising-expenses

What I think is more important is how younger people arrive at a point to be able to do this. Here is what we did to be able to take off in our late 30s: http://pacificsailors.com/about/dinero/how-can-we-afford-this

Vincent Bednar says

Can I ask who you get your boat insurance from? We were going to use Novamar, but they have just informed us they no longer cover boats under $150,000.00

Carolyn Shearlock says

We use BoatUS for a policy that includes the US East Coast and the Bahamas.