Understanding your insurance coverage will help you sleep better as a cruiser. Probably no aspect of insurance is more confusing than determining your hull value. And how the hull value is related to the premiums you pay.

Luckily Laura Lindstrom-Croop makes it all clear in today’s post—the second in her series on understanding insurance when you live on a boat. (If you missed the first part, check out Insurance When You Live on a Boat: Where To Start.)

After deciding which agent you are going to work with, the single most important decision to make regarding your policy is your hull limit.

This sounds simple, just use the price you paid for the boat. But wait a minute, what about those davits you added, or that array of solar panels?

You need to consider several things when determining the hull value.

Hull Value vs Price You Paid

After you bought the boat, how much did you spend upgrading it? Did you get the boat for a lower price because of a distress sale situation?

The sales price may not be your best guide for many reasons.

You must ask yourself: if the boat sank, would I be able to go out and buy an identical boat for the hull limit I am using?

Your answer should be yes. The purpose of insurance is to make you whole after a loss.

The insurance definition of hull value is the total of the hull, machinery (think engines and generators), all electronics (GPS, AIS, radios, SSB, etc.), and sails and rigging. Think about everything necessary to make the boat move.

One benefit of getting an insurance survey is that marine surveyors will also come up with an estimate of what they feel is an accurate hull value for your boat at the time of the survey. A surveyor will compare your boat with others that are currently on the market for sale. This will also help you make sure your value is comparable to similar boats.

Lowering Your Premium

How do you get a company’s lowest rate?

Many factors go into calculating your premium. On average, premiums are a percentage of your hull amount. They average from 1% – 3% normally. So a $200,000 boat with a 1% rate would cost $2,000 to insure or a $100,000 boat with a 3% rate would be $3,000 to insure.

What exactly determines your rate?

There are many factors used by an underwriter but here are the big ones:

- Age of vessel – newer boats get lower rates

- Type of construction – fiberglass, wood, steel, carbon fiber

- Navigation area – the US only, Bahamas, Caribbean, east or west.

The biggest discounts are given to boats in the US only, but what fun is that?

An underwriter will also consider

Experience

Yes, when asking for quotes put down all your boating experience, it matters. If you know how many miles you have sailed your boat put that down on your application.

Licenses and Certifications

List all your boating/sailing classes, or certifications including USCG licenses, ASA Sailing courses, etc.

Lay-Up Period

This is when you agree to put your boat on the hard, normally during hurricane season for a credit on your insurance.

WARNING: Read your policy, if you are taking this credit you must be off the boat, not living or working on it while it is on the hard. If this applies to you please check with your carrier. If your boat is supposed to be laid up, and a fire breaks out while you were working on the boat you may not be covered.

Your Claims History

You will get a lower rate if you have had no claims.

If you did have a claim it’s a good idea to describe it and what you have done to prevent it from happening again.

Now you know how to determine your hull value and the kind of things that you can provide so that the underwriter can give you the maximum credit based on your personal experience.

But there is more…

Not Covered In Hull Value

What’s not covered in the hull value?

- Spare parts

- Life raft

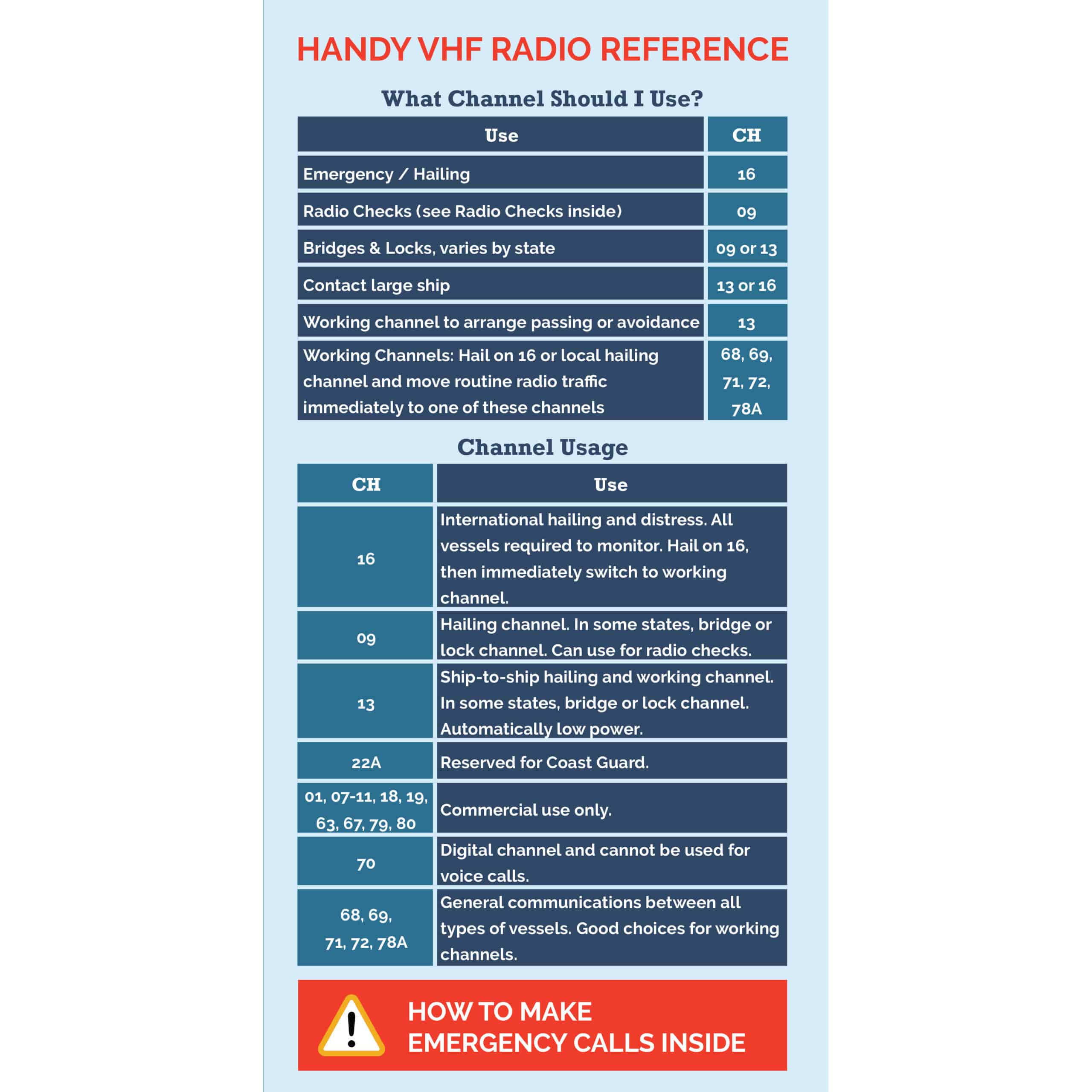

- Handheld VHF

- Cell phones/ iPads/personal electronics

- All personal items: clothes, galley ware, cameras, scuba equipment, etc.

I have seen from experience that most people go with 5k or 10k in coverage for their “Personal Effects” coverage.

That may be fine for your situation. But be aware, if you have a total of 20k in contents and you insure 10k, you are underinsured, and in the event of a claim may not get your full claim paid.

Another thing to consider is that a lot of yacht policies cover your items for their Actual Cash Value (ACV). So if you own an 8-year-old iPad, the insurance company will not pay for a new one unless you have a rider on your policy for replacement cost.

It is a good idea to have a general list of all your contents and their value. Some people even take the time to photograph higher value items.

It is also a good idea to photograph each bookshelf and locker as a reminder of what items were on board, in case you ever have a total loss.

It is always better to have more documentation than less when dealing with insurance companies.

Special Notes About Dinghies

What about dinghies? Some companies cover dinghies in the hull value. But the problem with this method is that the hull deductible is high, so your dinghy value may be under your deductible. It’s best to insure the dinghy and outboard with its own limit and a lower deductible.

One warning on dinghy coverage- most companies have a requirement that your dinghy must be locked to either the dinghy dock or at night to the main vessel to be covered for theft. They will not pay if it just disappears, so be sure to lock up your dinghy.

For documentation take a photo now and then of your dinghy locked up to a dinghy dock, you never know when you may need it.

If your dinghy does get stolen keep the cut cable or lock as proof. Or get the names of people who may have seen your dinghy locked as proof that you had it locked to the dock. Also, lock your outboard to your dinghy, this is what most thieves are after anyway!

Limits and Premiums

These three coverages, Hull, Personal Effects, and Dinghy will each have a limit and deductible followed by a premium on the companies quote sheet.

Don’t be shy, if you want to see prices for different limits. Just ask.

A company should not mind quoting you several ways until you are happy with your coverages and premiums.

In my next article, I will cover all the additional coverages available to you on a yacht policy, such as protection & indemnity liability, medical payments, uninsured boaters, and pollution liability.

Laura Lindstrom-Croop has worked as a Claims Adjuster and as an Insurance Agent for over 35 years. She brings a unique perspective to the insurance business as a liveaboard cruising sailor with an Atlantic crossing and over 20,000 miles under her keel over the last 12 years. Her current cruising grounds are from New England to Trinidad. Laura currently works for International Waters Insurance Services, an independent broker that specializes in marine coverages. If you have questions you’d like Laura to address in future posts, leave a comment below or email her at [email protected].

Flatten the learning curve with practical how-to info that gives you the confidence to step into life aboard.

Start Learning Today

Eric Montgomery says

Great article and thank you. Quick question, does the provider of the course/certifications make a difference for insurance purposes–ie if you have ASA vs NautiquEd vs US Sail is their a school that insurance carriers prefer or offer lower premiums with?

Carolyn Shearlock says

What the insurance companies accept and how they treat the various courses changes all the time and from company to company. I wish I could give any definitive answers. Just know that ANY courses are going to help! ASA seem to be generally recognized, as are RYA, but that’s not to say that other courses aren’t great.